MSACCO App Privacy Policy

We ensure that client data and credentials in the MSACCO App are well protected under the international data and user privacy standard guidelines.

For Africa’s low and middle income earners, MSACCO is the gateway to a variety of community-responsive and affordable financial services provided by a growing network of Credit Unions and MFIs.

Through reliable and secure digital channels, end consumers are able to grow personal savings, access affordable credit and make payments. By empowering the subscribers to make informed choices, we enhance their freedom to determine their financial destiny.

Why MSACCO?

MSACCO, serves the purpose of enhancing financial inclusion and accessibility, streamlining operations, and improving overall financial freedom for both the institutions and their members.

It enables efficient and secure transactions, leading to better financial empowerment and improved customer experience for both SACCOs and MFIs.

What is MSACCO?

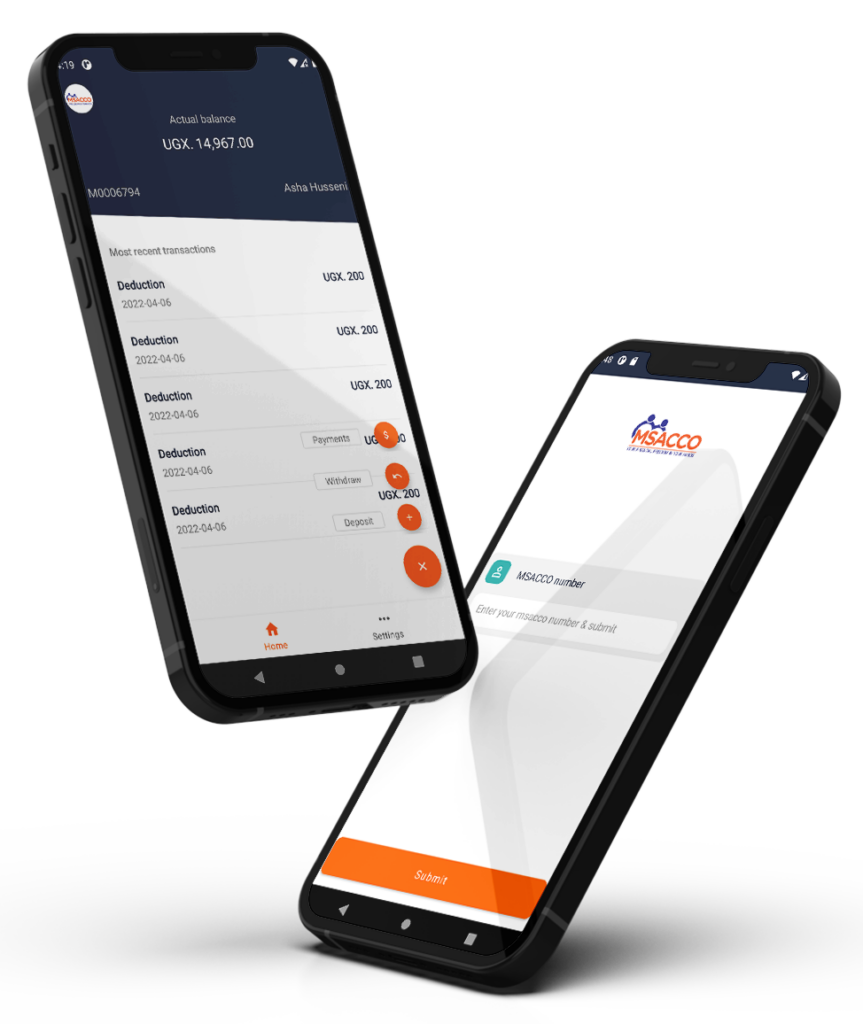

MSACCO is the most convenient and effective solution for SACCOs and Microfinance to provide mobile financial services to its members and customers respectively.

With MSACCO, members can make deposits and withdraw money from their respective accounts, make payments to various SACCO products. Payments to the SACCO via MTN Mobile Money or Airtel Money have now been simplified. Members can also access their funds through INTERSWITCH ATMs and POS.

Be able to transact using different channels, anytime, from anywhere. No need to travel to the banking hall anymore.

Increased dividends payout due to growing efficiency at the Credit Union (SACCO) or Micro Finance Institution (MFI)

Monitor the activities on your account. No surprises, keep track of your money on your phone anywhere, anytime

Access to more affordable credit due to improved Credit Scoring, resulting from frequent transactions and access to the Credit Reference Bureau.

Regardless of which town, village or country your members shift to, keep serving them through MSACCO

No need for setting up multiple banking halls any more. Members no longer need to come physically to transact

Generate repetitive incomes from every carried out transaction by the SACCO's or MFI's members.

SACCOs and MFIs are able to reduce their monthly infrastructural cost by 90% and hence improve efficiency and profitability

Call the number below at your convenience

Toll free: 0800 220 220 (UG)

Working Hours: Mon – Sat

(07:00 – 21:00 Hrs)

Our Awards: First African company to win the Global SME Finance Platinum Award for Product Innovation of the year 2022